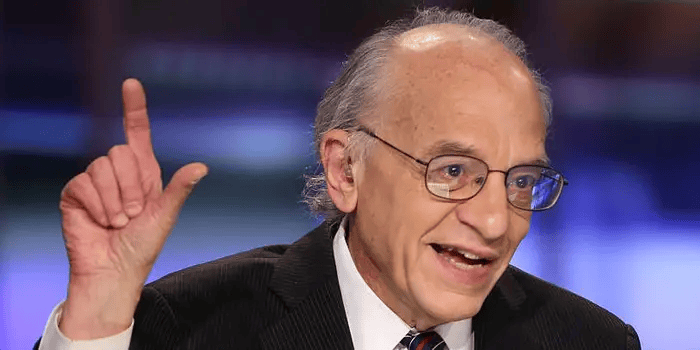

After a strong run in U.S. equities, expectations for outsized gains may need to be reset. Wharton School finance professor Jeremy Siegel, a well-known voice on long-term market trends, believes the stock market’s performance next year is likely to be more moderate than what investors have recently experienced.

Why Siegel Expects Slower Market Gains

Siegel’s outlook is rooted in valuation discipline rather than pessimism. According to his view, U.S. stocks are currently priced for near-perfect conditions after benefiting from:

- A powerful rally led by large-cap technology and AI-related companies

- Improving inflation trends compared to previous years

- Strong corporate earnings resilience despite higher interest rates

However, Siegel argues that when markets move too far ahead of fundamentals, future returns naturally compress. Elevated price-to-earnings ratios leave less room for upside unless earnings growth accelerates significantly.

Interest Rates Still Matter

One of the key factors influencing Siegel’s forecast is the interest rate environment. While investors are hopeful for Federal Reserve rate cuts, Siegel cautions that:

- Rates may stay higher for longer than markets currently expect

- Even modestly elevated rates can pressure equity valuations

- Bond yields continue to compete with stocks for investor capital

From a financial markets perspective, this means equity multiples may stabilize or decline slightly, even if corporate profits remain solid.

Economic Growth Without Euphoria

Siegel does not foresee a major economic downturn. Instead, his outlook suggests a “normalization phase” for markets:

- Slower but steady U.S. economic growth

- Moderating inflation rather than a sharp drop

- Fewer speculative excesses compared to recent bull phases

In such an environment, markets tend to deliver single-digit or low double-digit returns, rather than the explosive gains investors have grown accustomed to.

What This Means for Investors

For long-term investors, Siegel’s message is not to exit the market, but to adjust expectations and strategy:

- Focus on quality companies with strong cash flows

- Pay closer attention to valuations rather than hype

- Diversify across sectors instead of chasing last year’s winners

Dividend-paying stocks, value-oriented names, and selective growth companies may perform better than high-multiple momentum trades if returns cool.

The Bottom Line

Jeremy Siegel’s outlook serves as a reminder that markets move in cycles. After periods of strong gains, moderation is often healthy and sustainable. While the U.S. stock market may continue to rise next year, investors should be prepared for slower, more disciplined growth rather than dramatic rallies.

For patient investors, a calmer market environment can still offer meaningful opportunities — just without the illusion of easy money.